Garden waste subscriptions for the period of April 2026 - March 2027 are now open.

From 1 April 2026, there will be significant changes to how Business Rates charge is calculated. These changes may affect the amount you pay.

Revaluations to Rateable Value are carried out every three years in England and Wales to reflect changes in the property market. On the 1st April 2026 new valuations will take effect which is likely to change your Business Rates bill.

The previous revaluation on the 1st April 2023 reflected the government's view on rental values of properties as of April 2021 during the ‘Covid Era'. As the revaluation for 2026 will reflect values as of the 1st April 2024, some businesses may see a spike in Rateable Value due to being the first post Covid rating period.

Local authorities and the district council do not decide how your Rateable Value is calculated or have input on this revaluation. This falls under the remit of the Valuation Office Agency.

The Valuation Office Agency have released draft Rateable Values for properties. These are subject to change however you can check your Rateable Value here .

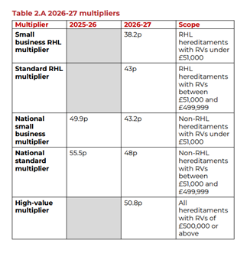

Your Business Rates bill at a base level before any relief is calculated by taking the properties Rateable Value and multiplying it by a national multiplier (pence in the pound). These multipliers are reviewed each year during the Autumn budget and implemented for the start of the next financial year.

Effective the 1st April 2026 multipliers will be reducing. There will also be the introduction of differing multipliers for Retail, Hospitality & Leisure Premises.

You can use the new multipliers below and your provisional Rateable Value above to calculate an estimate of how your Business Rates bill will change. Please note that these estimations would not include any supplementary reliefs like Transitional Relief or Supporting Small Business Relief.

“My property previously had a valuation of £20,000. My draft value for the 2026 is £25,000. It's an office so would be on the standard charge (not Retail Hospitality & Leisure (RHL)). How will this effect my bill?"

From the 1st April 2026 Retail, Hospitality & Leisure Relief will cease to exist. This means that businesses previously in receipt of this relief will no longer enjoy a 40% reduction in rates. Instead, there has been the introduction of the above multipliers for eligible businesses.

With the change from relief to multipliers, eligibility is no longer subject to a cash cap. Eligibility is largely dependent on whether your usage of the premises predominantly provides goods or services to visiting members of the public.

You can view the qualifying Retail, Hospitality & Leisure criteria and list of exclusions.

We are currently reviewing all Business Rates accounts and premises. If you believe you do qualify please complete this form, submitting it to NDR@stratford-dc.gov.uk

Businesses who lost some or all of their Small Business Rates Relief or Rural Rates Relief following the previous revaluation (1st April 2023) will have seen their Business Rates bill increase by a maximum of £600.00 per year until reaching the intended rate. This current iteration of the Supporting Small Business Scheme is due to come to an end on the 31st March 2026, however a one year extension has been confirmed. This means these businesses will only see a £600.00 increase for the 2026/27 financial year.

The new iteration of Supporting Small Business Relief will apply to any of the below:

For businesses where any of the above apply, your Business Rates bill will increase by a maximum of £800 a year until the current rating period ended (31st March 2029).

This will start on the 1st April 2026 in most circumstances, however businesses on the previous 2023 scheme will benefit from 1 final year at £600 per year before the new scheme starts on 1st April 2027.

For further information, please contact Revenues: