We use cookies to enhance user experience. We'd also like to use google analytics cookies to improve our site. You can read more about our cookies before you choose.

Stratford-on-Avon District Council always refunds any overpaid direct debits into the paying bank account.

Credits not paid by direct debit can only be paid into a bank account authorised by the liable person.

The council has been made aware of residents being contacted by unknown persons advising they have a credit on their Council Tax and asking for the resident's bank account or credit card details.

These calls are not coming from the council and are fraudulent attempts to obtain your bank or credit card details.

Always contact the council on 01789 260990 if you believe you have a credit that has not been refunded to you. A closing statement would have been sent to you showing any credit due.

Fraud can be reported to:

The SDC Council Tax team can be contacted at

Stratford-on-Avon District Council has been made aware of people receiving pre-recorded messages relating to arrears of Council Tax. We do not contact residents using this method, and so If you receive such a call, it should be treated as fraudulent.

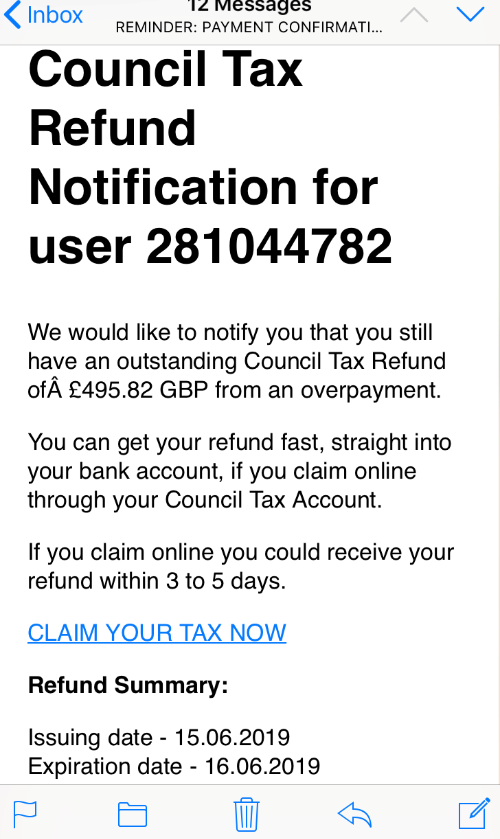

Stratford-on-Avon District Council (SDC) has been made aware of people receiving scam texts in various areas of the country.

SDC is not sending out any text messages about Council Tax refunds, and the advice is not to open any web link if a message comes through to you claiming it is from SDC.

The Valuation Office Agency (VOA) also provides information on bogus Council Tax scams .

Examples of scams to be aware of include:

Calls have been taken in the Contact Centre recently involving a potential scam targeting residents in the area. In this case, a lady purported to be representing the SDC's Council Tax department. It was in regard to a potential refund of thousands of pounds following a change in Council Tax banding. On this occasion the lady requested bank details up front in order to facilitate the refund as well as a £65 upfront payment for admin costs. When the request was refused and the resident requested the number to call the company back on, to verify that they were genuine, the caller slammed the phone down.

This was not a legitimate call and we would not request payment in this manner from residents. If you are in any doubt, please verify with the council using the Council Tax helpline on (01789) 260990.

The council has become aware of an increasing number of cold calls from fraudsters calling Council Tax payers telling them their Council Tax band has been reduced, and requesting bank details and dates of birth to process the refund.

A reference number is given along with a telephone number, 0905 005 0400.

If you receive such a call you may wish to contact the police. Never divulge information unless you are sure of the identity of the caller.

To check if a call is genuine contact the Council Tax helpline on 01789 260990.

A resident in the district got in touch to say they had received a call stating that they were entitled to a Council Tax refund.

The caller claimed to be from SDC and that they would be making a personal call to their property to refund an over-payment of Council Tax.

This is not genuine and they are not from SDC.

If a Council Tax payer does overpay, SDC will arrange a refund direct to the paying bank account or will send a cheque to the account payer. These refunds are not hand-delivered.

A resident in the district got in touch to say they had received an unsolicited call. The caller claimed that they were working in conjunction with the Government and suggested that the property was incorrectly banded and that they could offer to employ a surveyor at a cost of approximately £160. They also advised if looked into independently it may cost a lot more, around £700.

This is incorrect. All appeals against the council tax band can be made free of charge. Please see the Valuation Office Agency's Website for further information.

A resident notified the Council recently that they had received an email from “noreply@council.info".

This contained a pdf attachment letter that said,

“Dear Customer,

You have an overpayment_city_council_bill return due, for last May 2018. If you need a refund from us, take a look at the following short link: ……"

The letter had a HMRC logo and links within the letter. This is not from Stratford District Council. Advice is to delete it from your email without clicking on any of the links.

Unsolicited text's similar to the image below directing you to click a link are almost certainly malicious attempts to obtain your data.

Guidance has been circulated by the HM Courts & Tribunals Service over a recent increase in fraudulent activity. The Council's Enforcement Agents, Bristow and Sutor, have further information.

If a caller comes to your house claiming they are from the council and that you are owed a refund for Council Tax and you cannot establish their identity by calling SDC, or if you have any doubt regarding their identity, we advise you dial 999 and ask for the police.

All SDC employees carry staff identity cards and will be happy for you to call the council on 01789 267575 to check their authenticity.

Remember: never disclose personal or valuable details such as your date of birth, passport or driving licence number, credit card or bank details, security numbers or passwords.

There are companies who offer to try and get a Council Tax band reduced on behalf of a Council Tax payer; these companies will normally charge a fee or a percentage of any savings. Council Tax payers do not have to be represented in discussions about their Council Tax bands. Appeals against bands can be made free of charge and the council's advice is to contact the VOA on 03000 501501 to discuss the band.

However, ratepayers who do wish to be represented should be aware that members of the Royal Institution of Chartered Surveyors, the Institute of Revenues, Rating and Valuation and the Rating Surveyors' Association are qualified and are regulated by rules of professional conduct designed to protect the public from misconduct. Before you employ a Council Tax adviser, you should check that they have the necessary knowledge and expertise, as well as appropriate indemnity insurance. Take great care and, if necessary, seek further advice before entering into any contract.

For further information, please contact Revenues:

Is this information helpful?